YASO Takeaways: China’s 618 Shopping Festival

As the dust settles on China’s annual “618” shopping festival, YASO takes a quick dive into some of the key emerging trends and takeaways from this years near three week long event.

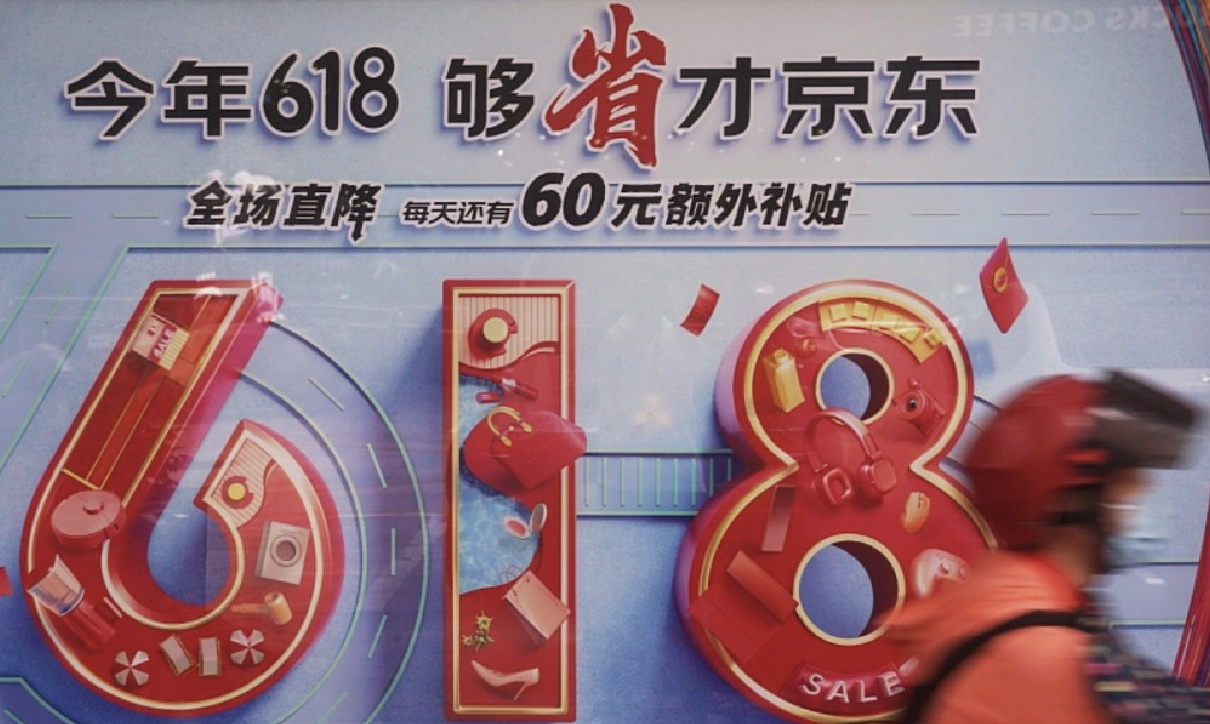

What is “618″?

“618” is an online Chinese shopping festival created by JD.com (one of China’s largest B2C online e-commerce retailers). It is China’s second largest shopping festival after Singles’ Day (or Double 11 in Chinese) in November.

Conceptualised in 2003, the number 618 reflects the founding date of JD.com(June 18 1998). It officially runs from May 31 through to June 18.

Although originally created by JD.com, other platforms such as Taobao, Pinduoduo and others, have adopted the 618 festival. This year saw a significant amount of activity due to overlapping dates with Father’s Day and the Dragon Boat Festival.

Source: JD Corporate Blog

Why is 618 a golden opportunity for international brands and companies?

The potential for international brands to reach the massive $1.7tn e-commerce market and audience in China is particularly palpable during the 618 shopping festival.

With billions of USD in sales occurring across several e-commerce platforms, 618’s volume of sales rival those of Black Friday in the US.

A number of foreign companies that operate in China take part in the festival and offer their own deals for the event.

This was evident in the case of Apple, who held a rare livestream and offered discounts on its products during the festival, including the iPhone 14 Pro and Apple Watch Series 8. Within the first hour, the broadcast had attracted 1.3 million viewers and garnered 300,000 likes.

Source: Jing Daily

New faces, such as, Moncler and Lemaire, also participated on Tmall for the first time this year, signifying a growing presence for global brands at the event.

How was 618 in 2023?

Results this year were mixed.

Neither JD.com nor Alibaba disclosed their total gross merchandise volume (GMV) figures this year (these are a key metric of e-commerce success), suggesting that results were not as prosperous as initially hoped. Sales for JD.com rose between 6-8% during the 618 festival period, and while this beat conservative estimates of 2-5%, it fell short of last years 10.3% increase and the sizeable

27.7% growth seen back in 2021.

Nevertheless, there were some positive signs. Within the first 5 minutes of 618, the transaction volume of JD’s cross-border platform exceeded the total sales of the first two hours from last year. Despite comparatively muted consumption overall, cosmetics and luxury goods saw significant gains in sales this year (more on this below).

In addition, over 23% more brands achieved the RMB 100-million-yuan sales milestone within the first ten minutes compared to last year.

An in-depth analysis of over 40 platforms, 88,000+ brands and 20 million commodities by third-party data provider, Syntun, showed that the total GMV of all the major e-commerce giants amounted to over $111 billion (798.7 billion RMB), a significant figure.

Even if the growth numbers are not what they once were, the success of 618’s early-sale period solidified substantial growth for China’s e-commerce platforms.

Source: Reuters

The Beauty Market

Sales of high-tech skincare products targeting wrinkles and skin nourishment surged during 618. On JD.com, 150 beauty and skincare brands, including YSL, Lancome, and specialist skincare brand Proya, doubled their transaction volumes YoY in the first 10 minutes of 618.

On Alibaba, within the first hour of 618, global cosmetics powerhouse, L’Oréal racked up sales of $14 million (over 100 million RMB). Products such as Estee Lauder’s Micro Essence Lotion Infused with Sakura Ferment, and YSL’s Clarinet Lip Glaze 610, and 943 Lightweight Sunscreen, sold more than 10,000 pieces in the first hour.

Beauty devices also became a hot commodity this year. Domestic beauty tech brand Seayeo sold out of its LED facial beauty light in 20 seconds on Taobao, achieving a turnover of $13.9 million (RMB 100 million).

Infamous Chinese pop star Zhou Shen perform on Ipsa’s (a Shiseido brand) Taobao Live slot. IPSA’s lotion package had sold out within three minutes after the livestream started.

Growth within these categories highlights how lifestyle trends, notably an increased focus on beauty, health and wellness, are becoming more prominent in the minds of Chinese consumers. Beauty and skincare brands realised this and jumped at the opportunity.

Source: Alizila

Strength of Luxury Brands

Luxury brands saw significant leaps in sales this year during 618. Renowned brands such as Celine and Bulgari enjoyed a five-fold increase in transaction volume year-on-year. Even more impressively, brands such as Max Mara, Valentino, and Maison Margiela experienced a 20-fold increase in transaction volume year-on-year.

According to Tmall data, in the first 30 minutes of the 618 festival, Burberry, Chloe and Miu Miu’s sales exceeded their entire respective total sales during the shopping festival a year earlier.

This year many brands also launched new products online and offered customers rare discounts, along with incentives such as interest-free payment in instalments.

On Tmall, brands such as Coach and Jimmy Choo offered consumers alluring discounts, with the former discounting some of its handbags by 75% and the latter selling its signature Romy heels at 50% off. A Tmall site-wide coupon offer also gave consumers a $7 (50 RMB) discount for every $42 (300 RMB) spent.

Discounts provided by brands during 618 and their significance provides an appropriate segue into the following takeaway.

Source: Tmall

Discounted Products and Cautious Consumers

By its lofty standards, the 618 festival in 2023 was somewhat of a quiet one. As mentioned earlier, the notable absence of the official gross merchandise value (GMV) figures hinted that weak consumer spending in China might be taking a toll on the country’s tech and e-commerce giants.

These numbers have consistently been used in the past by these firms to demonstrate their ability and success to move a staggering number of products during the major shopping festivals. While they were still able to achieve this, it was not at the level expected.

In an attempt by online retailers to revive a relatively dormant consumer atmosphere and increase spending at China’s first major online shopping festival since the end of China’s zero-COVID policies, previously cautious Chinese consumers and shoppers were treated to steep discounts, new products and heavily incentivised payment plans.